I met friendly, young, Evelyn Naujokas while I was shopping at a small, local, home goods store in a neighboring town. She was watching the store for the owner who was on vacation out of the country and while people browsed she sat behind the counter patiently waiting to cash them out. I noticed she was working on a rag hooking project. This piqued my interest of course, being a stitcher myself.

I struck up a quick conversation with her intrigued by her quiet attention to her project. This was her first rag hooking project, which an older friend of hers had started her on. I asked her a few questions about her experience with the project which she happily answered. She cashed out my purchase and then I was on my way.

A day or so after that conversation with Evelyn I couldn’t stop thinking about her and her WIP (work in progress) so I messaged the owner of the shop, who is a lovely woman and friend and I asked her if the young woman watching her shop that day would be interested in sitting down with me for an interview for my new blog series on young crafters. She said absolutely!

Evelyn and I met a week later at the local library and for almost an hour we chatted about the things going on in her life, most especially her new love for rag hooking.

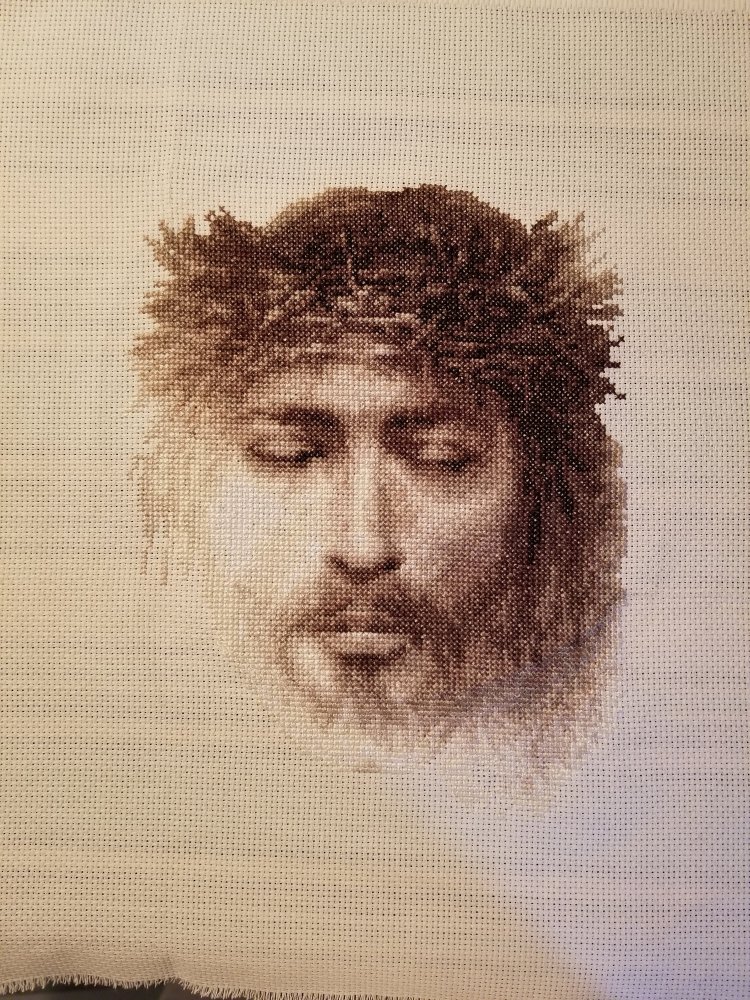

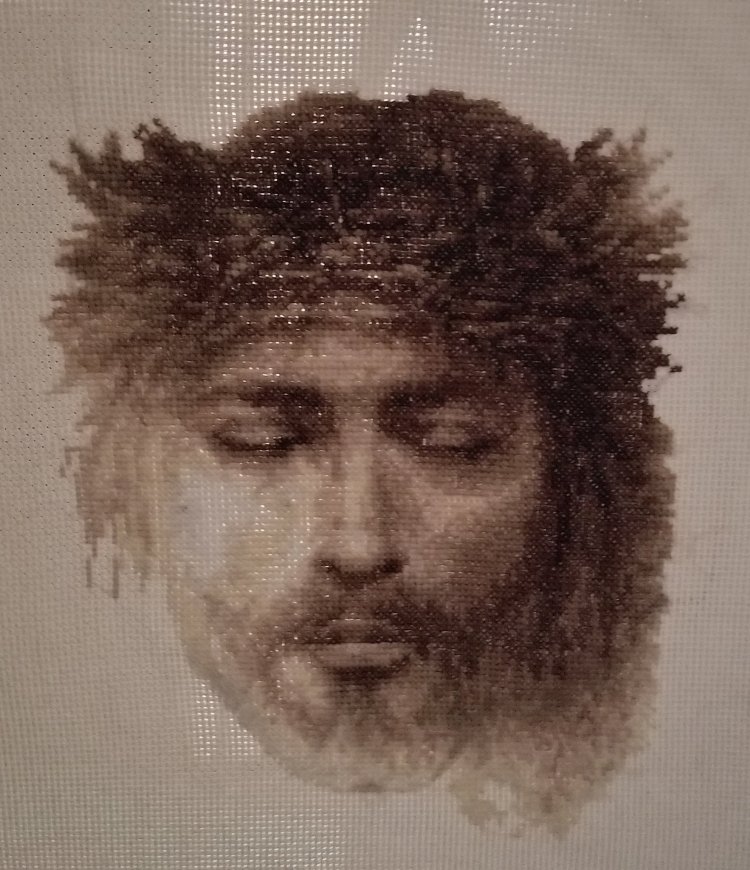

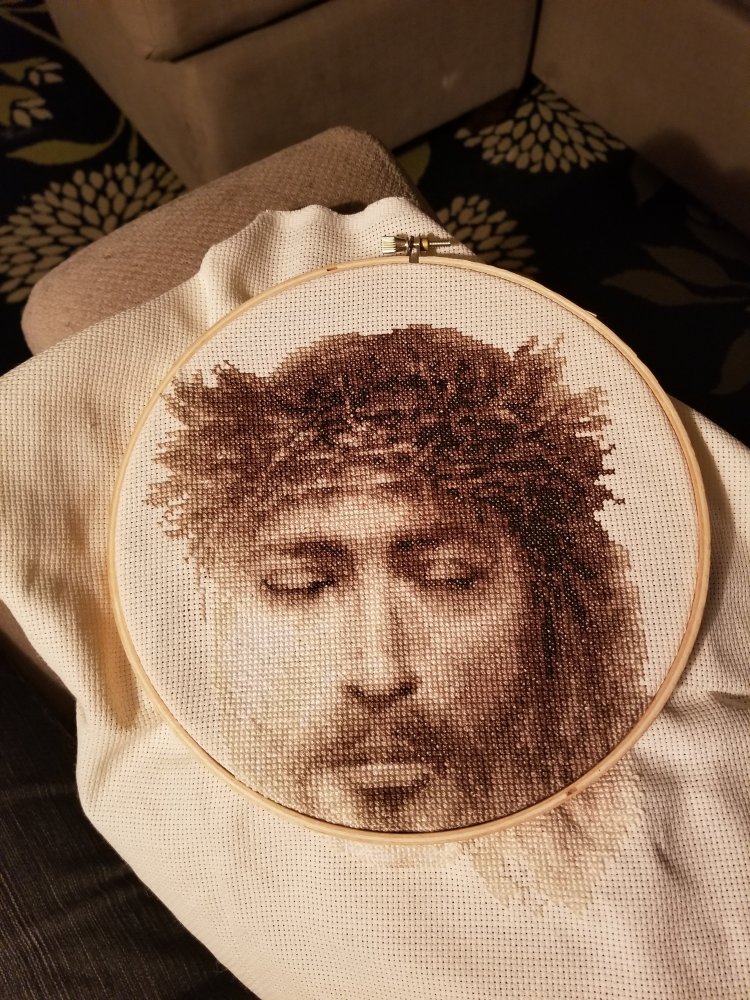

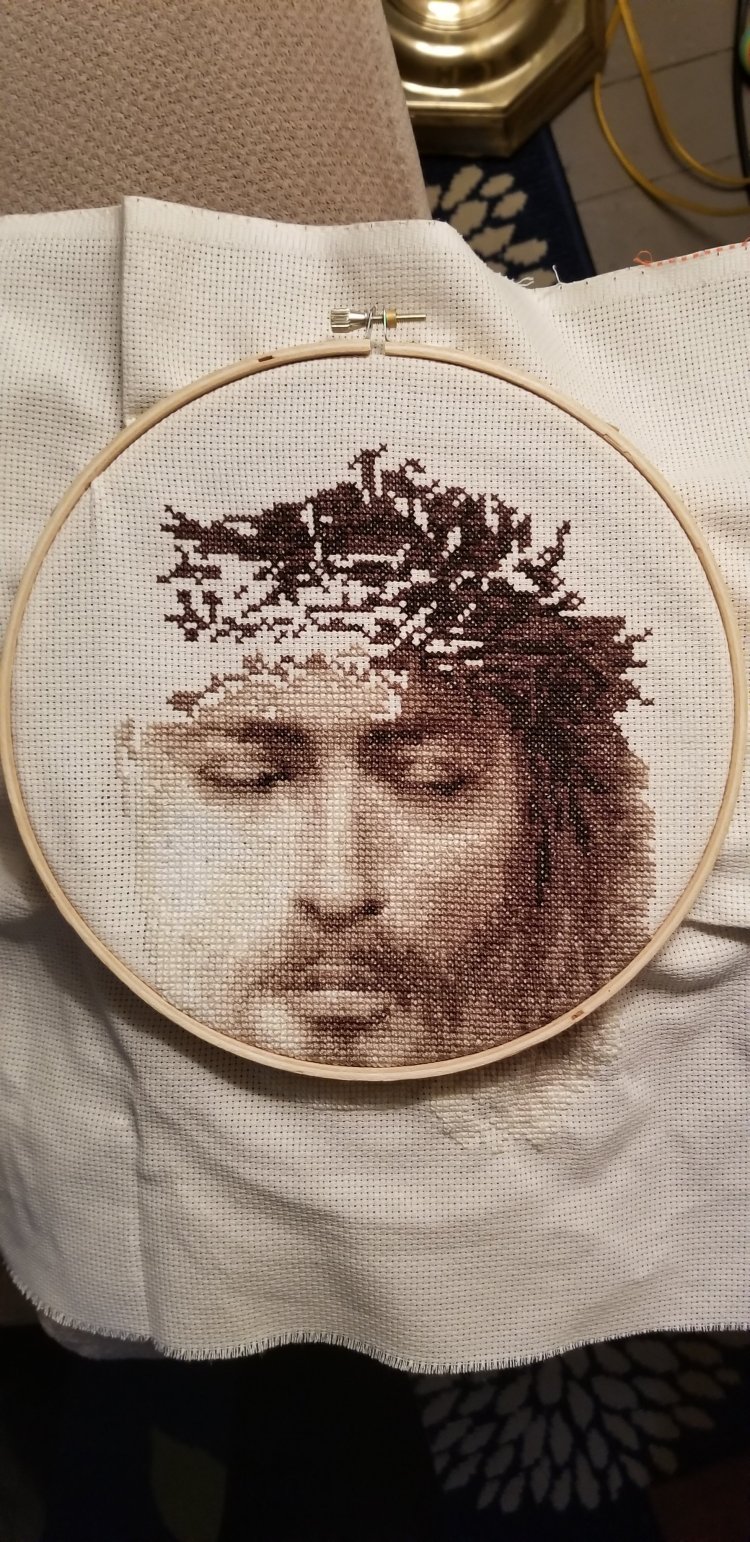

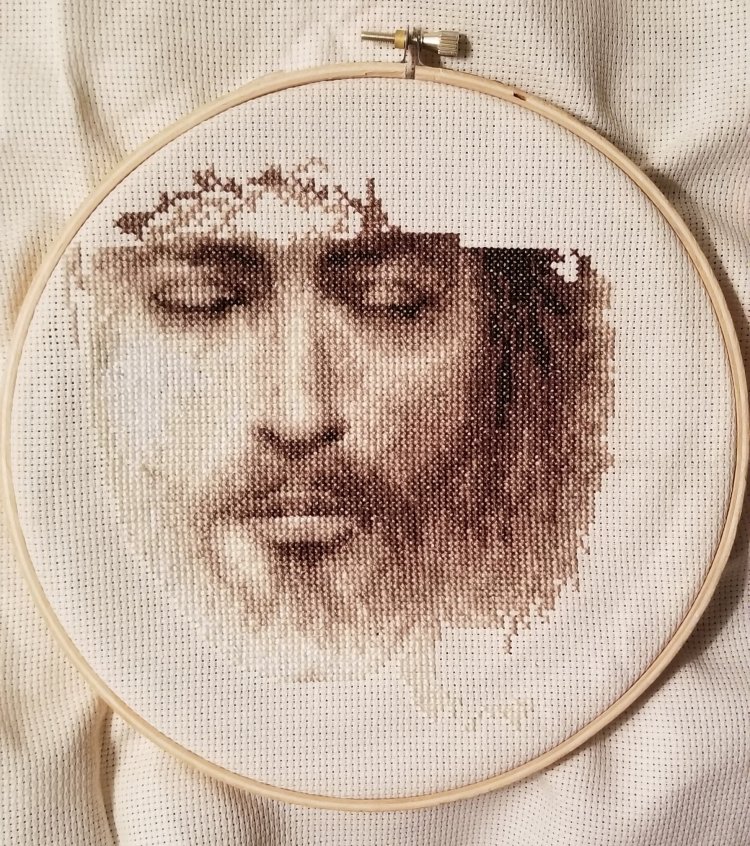

First let me tell you what rag hooking is. Rag hooking in my mind is a bit different that rug hooking in that you are using strips of old fabric instead of bits of yarn. While scraps of rags helped to use and not waste leftover fabric to make rugs a hundred years ago, now in the twenty first century people hand dye fabric to make it a craft instead of a necessity. A pattern is hand drawn on the canvas to be used and the fabric strips are pulled through with a crafter’s hook to make a raised loop which after hooking many raised loops along the hand drawn pattern an image forms.

I asked her how she became interested in this type of craft considering there are so many other kinds of crafts to learn. She said her boss at the restaurant she serves at part-time hosts a rag hooking crafters group once a month for food and conversation and of course hooking. Evelyn said she used to watch the group and what they were working on and after a few times of her boss observing her watching the group, presented Evelyn with her own rag hooking kit!

A little background on Evelyn….She comes from a traditionally conservative family with three sisters, all of them crafty in some way. They love to go to flea markets and turn their finds into treasures. Each of her sisters and parents have different crafting styles ranging from sign and furniture making, to watercolor painting and gardening. Evelyn is currently a student at Monroe Community College majoring in Interior Design but she also expressed interest in being a Sommelier. A Sommelier is a Wine Steward who works with managing wine selection, purchase, storage, sales, and service in the hospitality industry.

Part of our conversation turned to how rag hooking helped her manage her stress level during school finals and other stressful times in her life. We even talked about her view on social media and the good and bad that can come from using our phones and being on media like Facebook and Instagram. We both agreed it was very easy to waste large amounts of time on social media and browsing the Internet mindlessly. Evelyn said what she loved about hooking was at the end, when the project was done, she had something tangible she had accomplished. She does not get that feeling from scrolling through Facebook. What she did like about social media was seeing new ideas and styles.

I really enjoyed my time with Evelyn and I plan to stay in touch with her to watch her progress on her project.

I think crafting really brings people and their creativity together. I belong to a Stitch-A-Long (SAL) group where a group of us from all over the world, update our progress on our Works in progress (WIP) every three weeks. Now how would I have ever gotten to know these wonderful ladies if not for my stitching?

I plan to post throughout the summer, stories of different people I hear about that are bringing back vintage crafting styles. Believe it or not these types of crafts are not just for “old ladies” anymore. Instagram shows young people with extraordinary talent in long forgotten crafts.

There is so much more I could write about my conversation with Evelyn Naujokas but suffice it to say I think she is a very talented and personally engaging young woman with a good head on her shoulders. Thank you Evelyn for indulging me with my new blog series. It was truly a pleasure!

See you next week everyone with another young crafter’s story! -MM