2025 is done and gone and to be honest I am not sad about it. I feel like last year was kind of a lost year for me. One where I just coasted through and didn’t get a lot accomplished. I looked back on past years goals and got a ton done in those years. Not so much for 2025.

I have big plans for 2026, but I always have big plans, right?!

#1 Exercise/Walk More

It’s always a goal. I am determined to stay active this year.

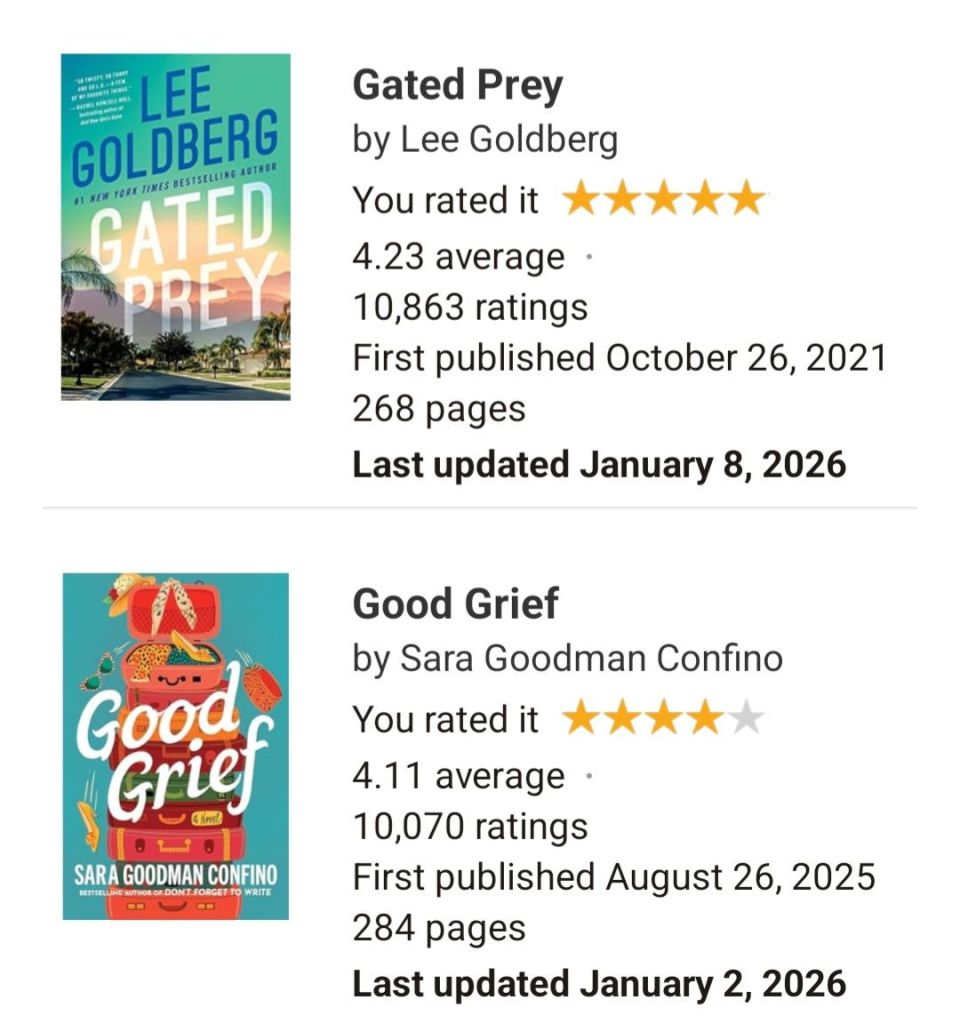

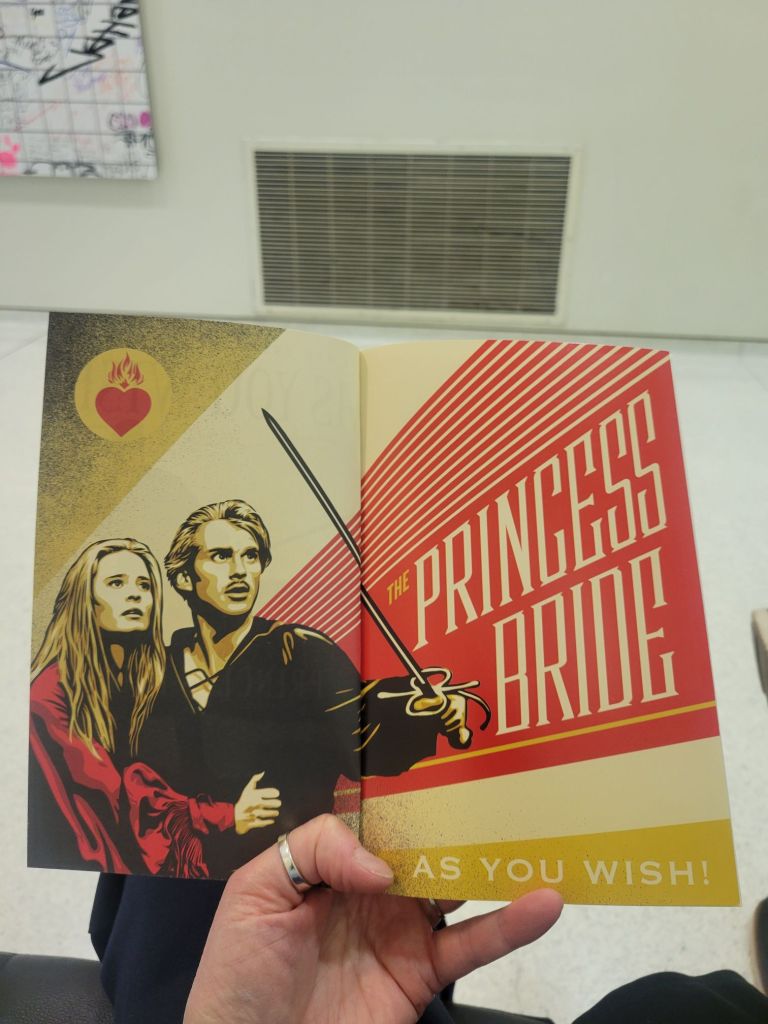

#2 Read 52 Books

Last year I had no real goals for reading and it showed. I only managed to read a whopping 10 books last year. There is a reason for that for which I will explain at the end of this post.

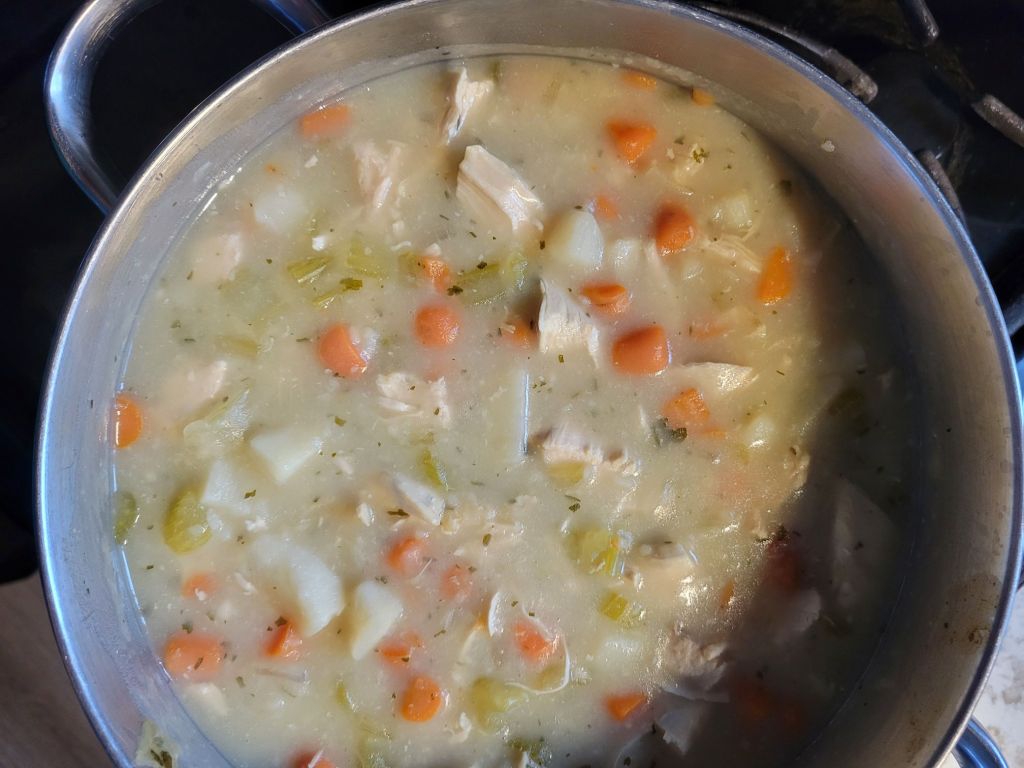

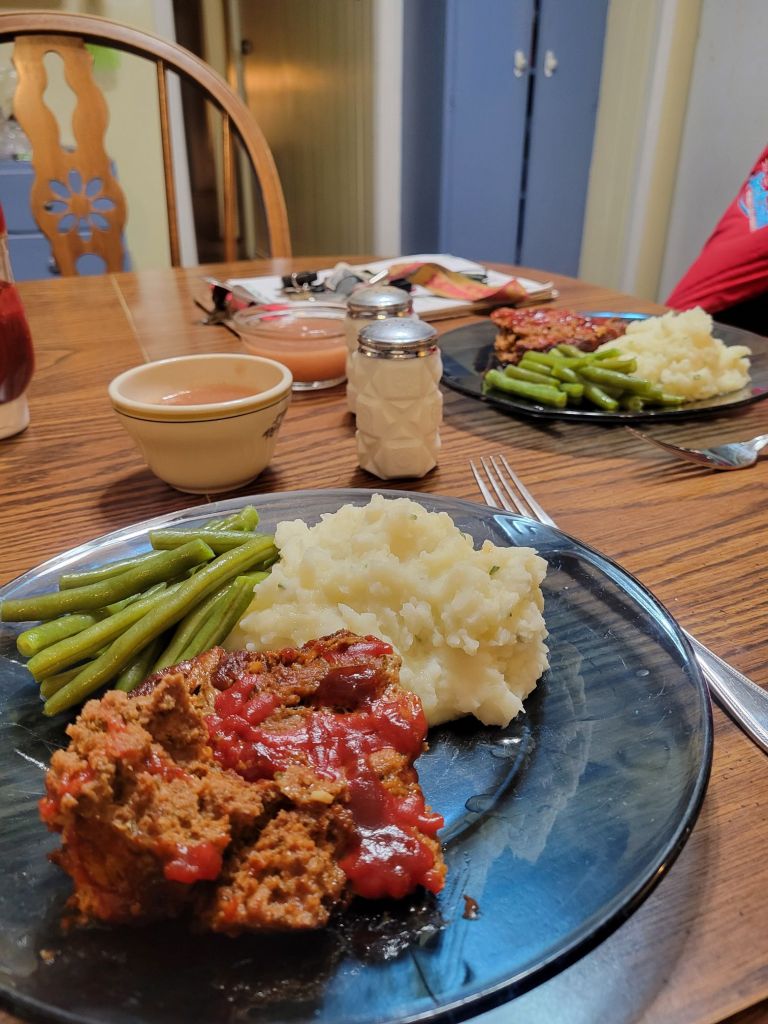

#3 Cook More At Home

Cooking more at home will save us a ton of money (it already has) AND my husband got freaked out after seeing something on the interweb about what is actually in grocery store bread so now I plan to bake bread for him. This leads into my next goal…

#4 Bake More For Us

Ok, this should be a no brainer but sadly I have to add this to my goal list. I bake for everyone else but most often NOT for us. This needs to change, thus it has been added to the goal list for this year.

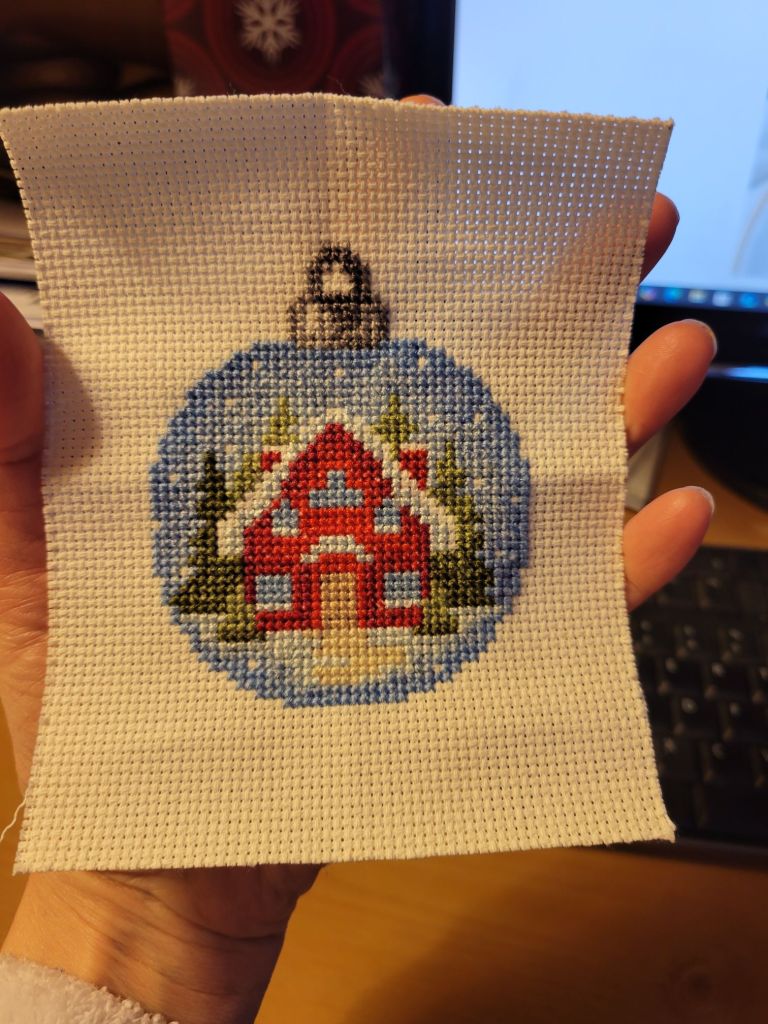

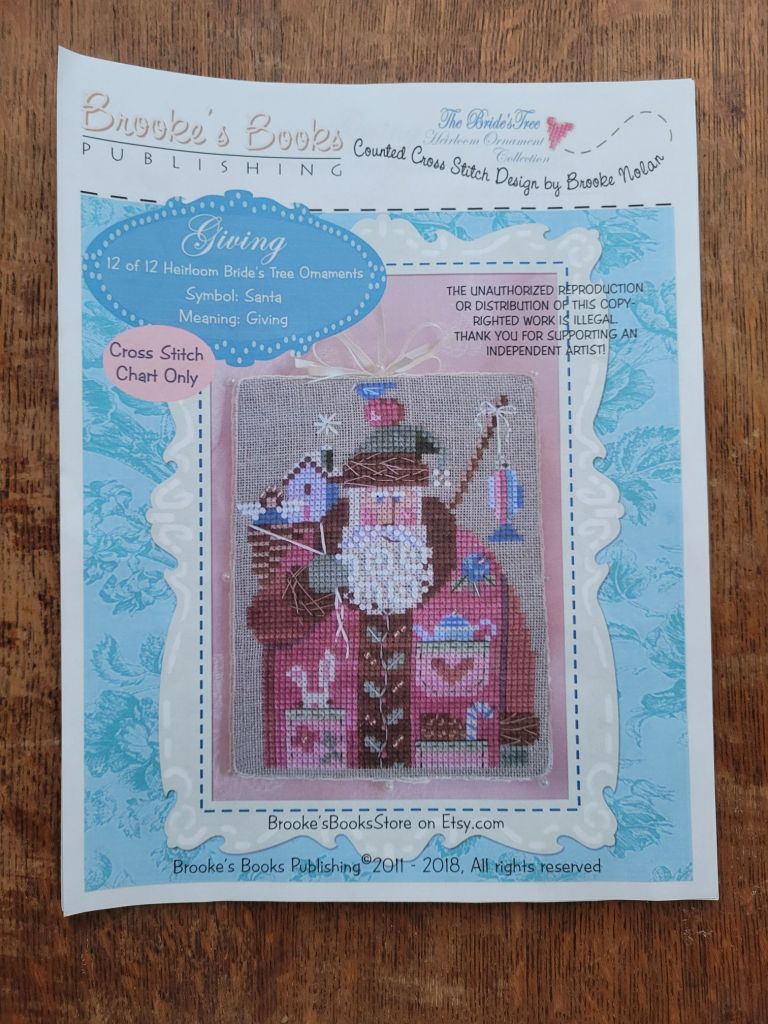

#5 Get $10,000 in Etsy Sales

In 2021 I got over $18,000 in Etsy sales. I can do $10,000 this year.

#6 Get My Little Bakery Cabinet Up and Running

I bought a little vintage pie cabinet last year and started working on it but the fact that it’s so tall and easily tip-overable kind of freaked me out last year so the Hubs has promised he will figure out how to stabilize it this year so I can properly use it.

#7 Journal as Much as Possible

I just have to make a spot that is comfortable that I can go to at the end of every day and write it all down.

#8 Home/Garden Focused

Last year was a bust so this year HAS to be better right?

#9 All New Wardrobe

The newest buzz word on the wardrobe scene is “capsule wardrobe”. It’s pretty much the new wording for “minimalist wardrobe” but either way I need to feel better about what I am wearing because every morning I change my clothes at least three times before being satisfied with what I have on, and not only is that frustrating, but it’s a time waster!

#10 Pay off $10,000 in credit card debt

This will be my goal every year until every last cent of debt is PAID OFF!

#11 Organize/Hoe Out House/Work on a Cleaning Schedule/Work Smarter Not Harder

I am drowning in stuff. I can’t wait to show you in my next update what I have already worked on!

#12 Spend More Time With My Husband

After the 3000 cookies I baked for Christmas and the constant pushing my husband aside to get said cookies baked, I have had enough of putting everyone else first and telling my husband he needs to scram so I can get said orders done. I actually like being around my husband (95% of the time) and we need to have more fun together.

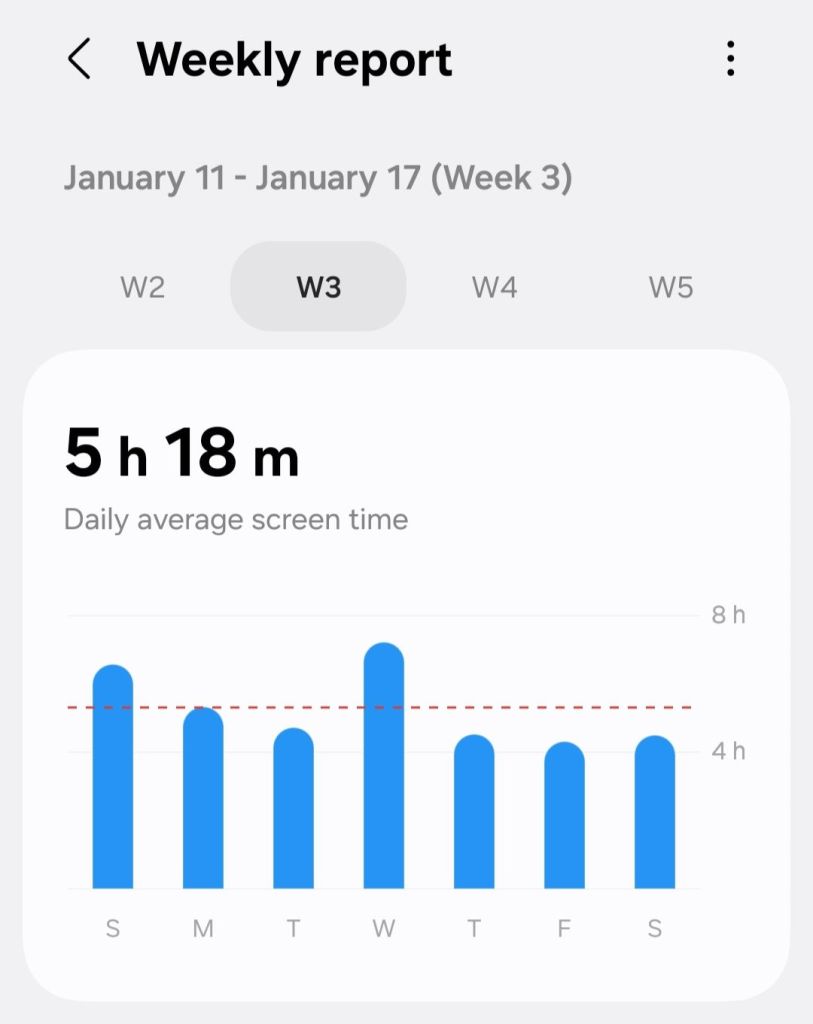

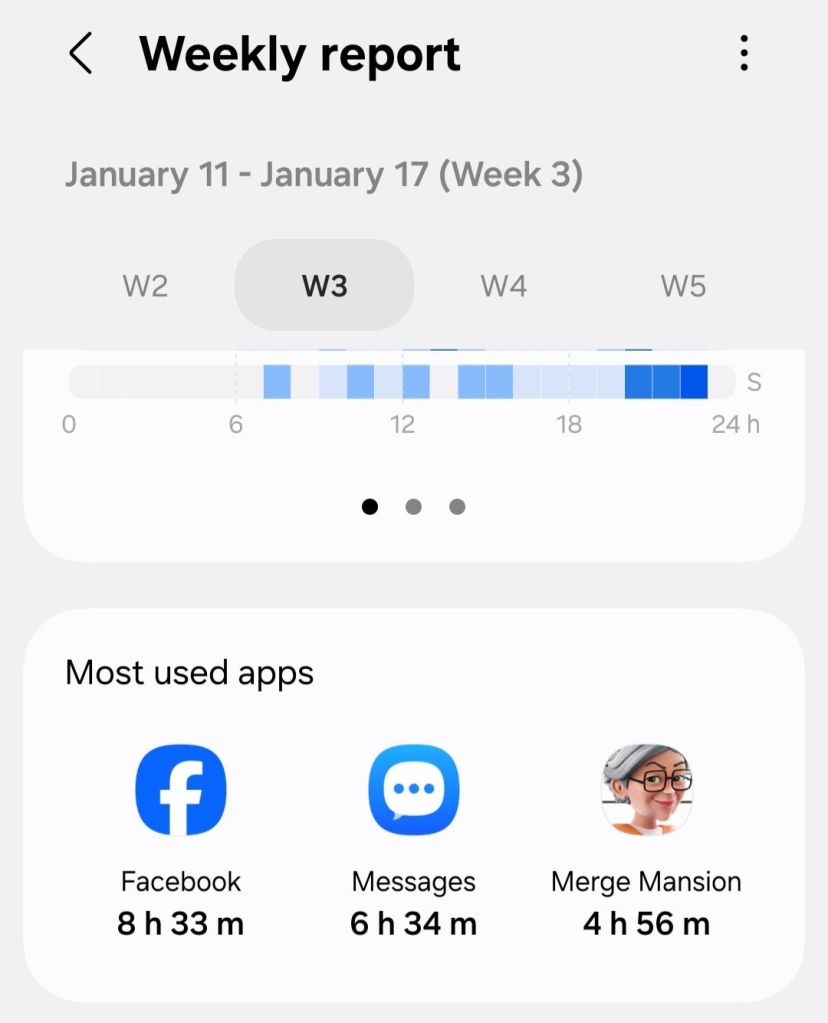

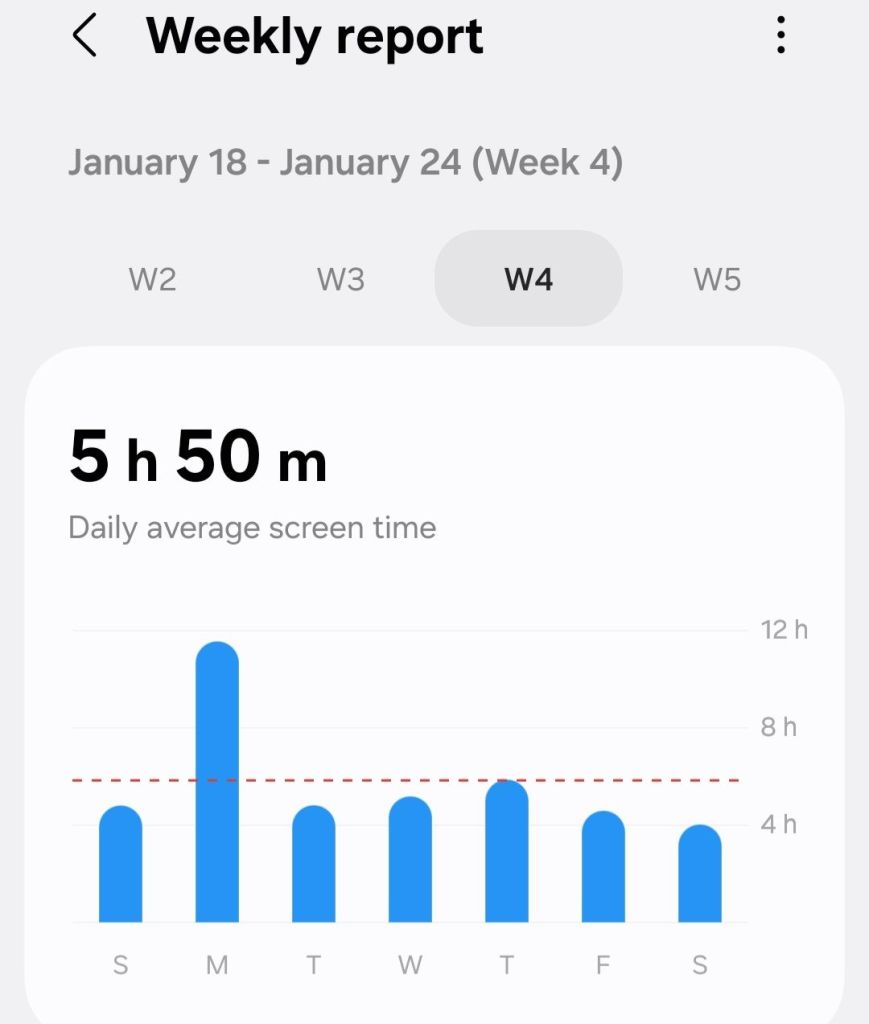

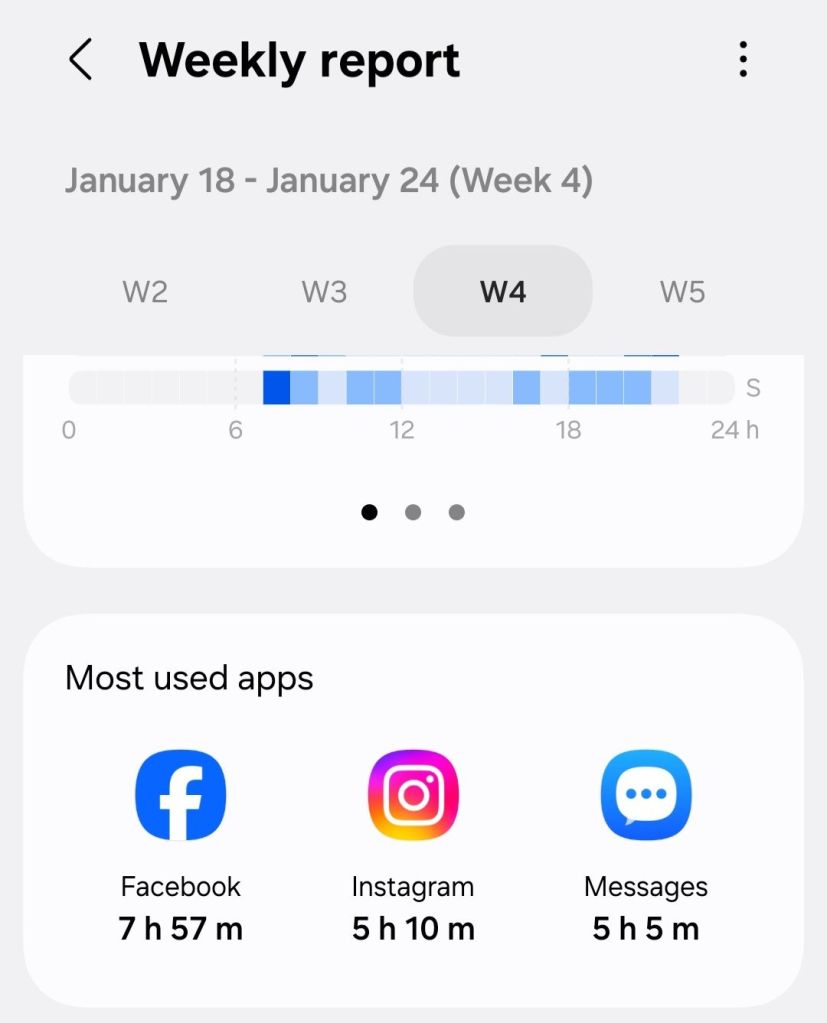

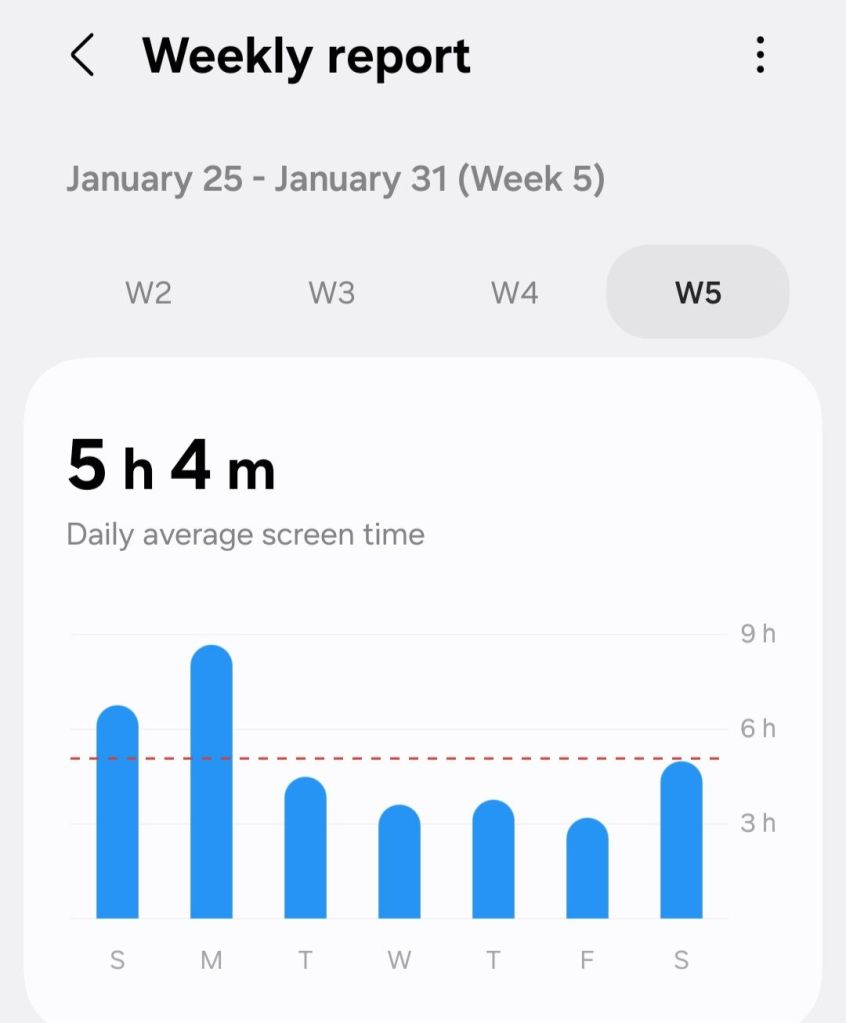

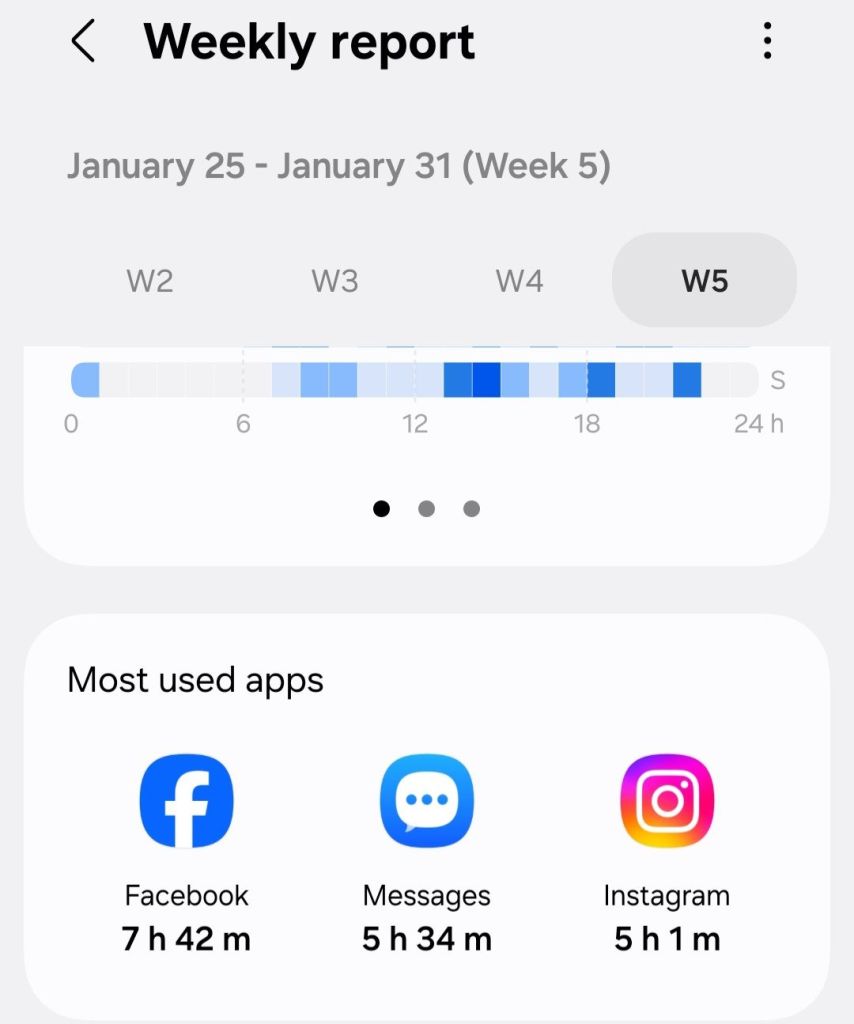

#13 Less Screen Time

I stated above that I didn’t get as much read last year for a specific reason. Actually many of my goals last year were not accomplished because of this very embarrassing issue. I am addicted to playing games on my phone. There I said it. Phew….admitting it is the first step right? It’s not something I want to say jokingly though. It’s a real issue for many. I know we all feel it. That pull every 30 seconds to look at our phone. To check Facebook and Instagram, to see if there is a text or an email or some other communication we feel we can’t miss. I have used playing games on my phone as a way to escape, but it has cost me valuable time. Seriously, I will play HOURS a day. Those hours I could be doing anything but wasting my time playing a game. So my goal this year is to wean myself off games on my phone and stop wasting time. Yes we all need down-time. We need mindless activities that will help our brains to rest but that kind of screen-time is not it!

Ok. That’s the list of goals I have for 2026. Nothing fancy but I like all of these goals.

What do you think? Do you have goals this year? Do tell -MM