So far I have spent a whole lot less for groceries this week than I did last week. Last week I spent over $200!

I ordered from Misfits Market this week but instead of fruits or veggies I decided I would try a cold pack which is meats and dairy. My entire order with them this week is salmon. I will be receiving five 12 oz packages of salmon for a total of $40.45 which includes shipping.

The most expensive thing I bought this week is obviously the salmon but the ground beef I bought should get an honorable mention too at $13.70.

I am still cooking for the other family I talked about in my last post this week, so some of our grocery bill includes extra for them.

So far I have spent $67.75 from the store and $40.45 from Misfits plus I received a credit from Misfits of $8.27 for damaged products last week so all things considered total for this week is $99.73.

On the menu this week:

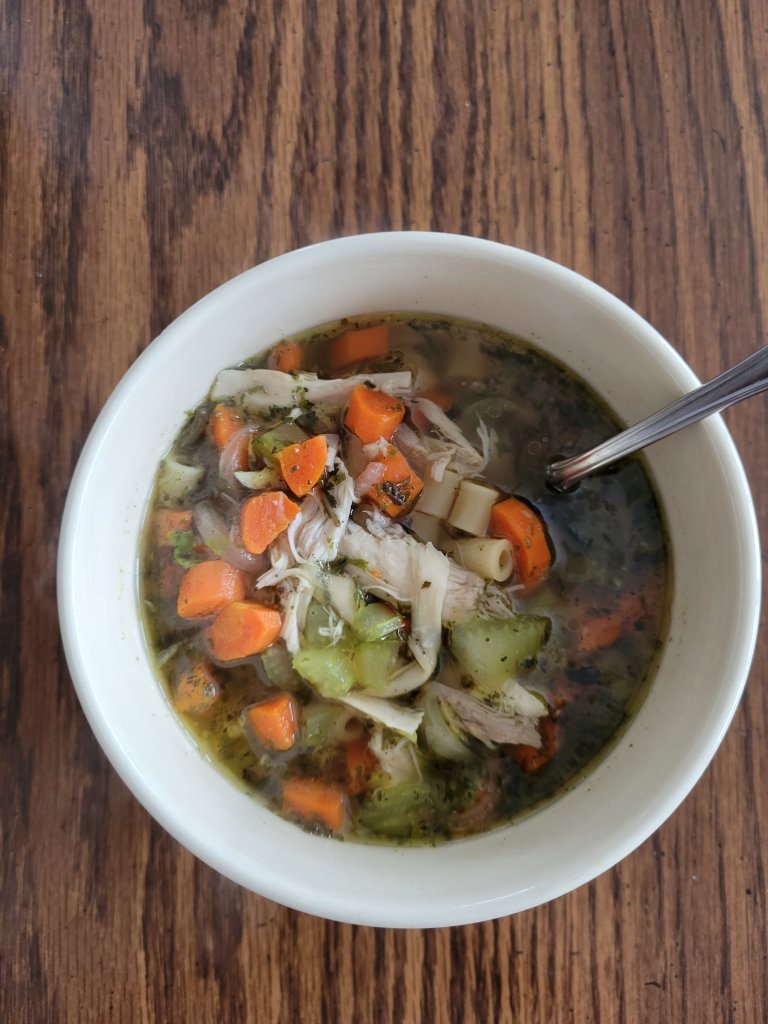

Dinners: Chili with all the bells and whistles, Roasted chicken with veggies, crockpot pork ribs in chili sauce, salmon with wild rice and veggies, nachos, and scalloped potatoes and ham.

For breakfasts: bagels, oatmeal with fruit, toast and eggs, hopefully some St. Joseph’s bread.

Lunches are pretty much leftovers and sandwiches.

If you would like the recipe for St. Joseph’s bread here is a link to a past post I wrote Baking for Lent That post also includes a recipe for Hot Cross Buns which are to die for. Both recipes are so good!

I enjoy hearing from all of you. The conversations I have had about these posts have been really interesting!

What is on the menu for all of you this week? -MM